An Update on the Energy Markets for Spring 2024

What’s happening in the energy markets — and what does it mean for consumers?

Paul Leanza, director of gas supply, and Joe Haugen, senior director of power supply, recently shared an update on the status of the markets. Here, we offer highlights from their update.

Power Market Updates

As electrification efforts take off, we’re seeing peak load rise for the first time in about a decade. Along with changes to capacity markets and grid interconnection delays, the power market is experiencing a pinnacle moment.

Peak demand is on the rise

Over the last several years, we’ve seen minimal electricity load growth in the U.S. — thanks in large part to energy efficiency initiatives and rooftop solar installations across the country. But in the last few years, as electrification efforts grow, larger numbers of electric vehicles (EVs) take to the road, and data centers require more and more power to run, we’re seeing a significant jump in electricity demand.

At the same time, it’s become more difficult to bring online and connect new power plants to the grid due to a variety of factors, notably market constructs and interconnection delays. From 2015 to 2022, U.S. power plants were bringing on more than enough generation to meet peak demand, but this trend has flipped. Today, we’re retiring plants — or expecting more load growth — at a rate higher than we’re building new plants.

Changes to capacity markets

Two of the largest costs that go into supplying electricity are capacity and energy.

The capacity cost acts as insurance, ensuring there’s enough energy on the grid to meet peak demand. This price is set at an annual auction. Energy is the actual delivered product, and, as it can’t be stored easily, its cost is set through an hourly auction. This cost is driven by both power plant efficiency and the fuel source.

Recent capacity market reform, aimed at determining generation resources’ effectiveness given emergency events, is expected to be bullish for capacity rates and, in turn, is likely to encourage new generation.

Grid connection challenges

Connecting a new power plant to the grid has become much more difficult, and hundreds of projects are currently in the queue awaiting approval. Of these, 308 projects were identified for fast-tracking to completion in 2024, primarily solar, wind, and solar plus storage projects. These generation sources will take time to come online — and will act much differently than the generation on the grid today.

And while renewable sources can produce energy at lower prices than fossil fuels, they can also create more risks for scarcity pricing.

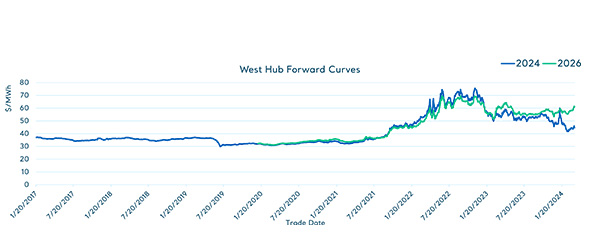

The impact on power prices

As concerns that there won’t be enough generation to meet rising peak demand rise, what’s the impact on power prices?

Customers wondering if it’s worth waiting to see if prices fall to pre-2021 levels should note the absence of key factors — notably, low load growth — point to a continuation of the trends we’ve seen more recently.

Ultimately, the fundamentals behind energy prices have changed dramatically in recent years, making it more difficult to time the market. It has become even more important to consider the challenges the current market presents and create a plan. Hedging load-following percentages through time can allow you to mitigate risk and leave the ability to capture any decreases in prices.

Natural Gas Market Updates

When it comes to the natural gas market, there are two notable elements worth focusing on: the buildout of liquefied natural gas (LNG) in the Gulf of Mexico, and how producers are going to respond to all this new demand.

The Impact of LNG Buildouts

Today, the U.S. exports between 12 and 13 billion cubic feet of LNG per day (Bcf/d), mostly from the Gulf of Mexico. When the LNG projects currently under construction are completed (by mid-2024), that number will grow by an additional 13 Bcf/d. By the end of the decade, it’s likely the U.S. will add as much as 21 Bcf of new export capacity. Most of the LNG needed to meet this demand comes from East Texas — in the form of associated gas produced during oil drilling — and from the Haynesville field in Louisiana, where the Henry Hub is located.

It’s important to note this progress has increased price expectations. Prior to 2020, before widespread LNG buildout, the Henry Hub Calendar '26 “comfort zone” was between $2.75 and $3. The comfort zone for that same period today is around $3.75 to $4.25.

Natural gas producer actions

To meet this rising demand, natural gas producers wanted to steadily increase production. But after one of the warmest winters in more than 70 years, producers found themselves in a situation where they will need to stay at a reduced output through the summer — possibly through the end of 2024 — to remove storage overhang.

This makes the transition to increased demand much more challenging for producers.

It’s worth noting U.S. storage capacity hasn’t kept pace with the growing gas industry, and a frigid winter could easily reset the supply/demand balance.

Natural gas price scenarios

Weather and end-of-summer storage levels will determine where natural gas prices land.

Higher natural gas storage going into the winter provides more cushion for normal- to below-temperature scenarios. If storage is high and weather is warm, prices may range from $2 to $2.50. If cooler, prices may range from $4 to $6. Right now, we’re seeing a winter price right around $3.40, but that could be closer to $4.50 or $5 in a cold scenario.

When we look at the natural gas forward curve as of March 2024, we consider the near term as average-risk. Prices are lower due to winter storage overhang and supply outpacing demand. The section of the curve we consider high-risk is mid-2025 to mid-2028 due to increased LNG demand we know is coming compared with unknown increased production timing.

Ultimately, bearish market sentiment in 2024 could make the transition to increased LNG exports more difficult, increasing potential volatility in 2025 and 2026.

For more from our energy supply experts, view this summary video.