Home Warranty vs. Homeowners Insurance: What’s the Difference?

.png?sfvrsn=3ca10010_0)

Avoiding repairs around the home is next to impossible. For homeowners, equipment and appliance wear-and-tear is a fact of life. What can be avoided is the frustration of having to pay more out-of-pocket for a repair that was assumed to be covered by an insurance plan.

Here, we highlight how home warranty protection differs from your average homeowners insurance plan — and how understanding what's protected is the first step toward peace of mind.

Protecting your lines and energy supply: How a home warranty plan differs from a home insurance plan

There’s a complex system that keeps your home running efficiently.

Imagine a water pipe bursting or a kitchen appliance breaking when you need it most, or even a utility line failing: You may assume your homeowners insurance policy will come to the rescue. But while homeowners insurance may cover some of the items damaged from this event, it won't necessarily cover the repair to things like a failed pipe or line. This can present a significant protection gap for those who have only homeowners insurance. After all, it's a matter of when, not if, lines and systems will fail.

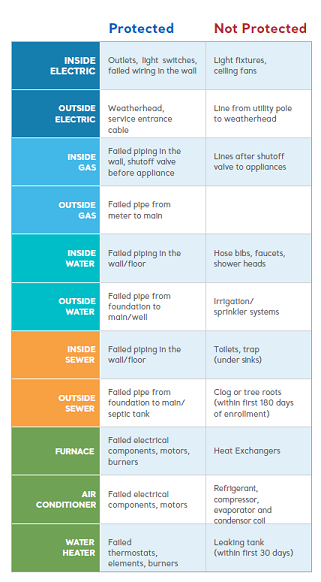

While a home insurance plan typically covers a specific system or appliance from unpredictable issues, a home warranty plan protects the cost of repair to lines, systems, and appliances affected by normal wear and tear.

When it comes to the pipes and lines that keep your home running, you may be thinking, “But what about the utility’s responsibility?”

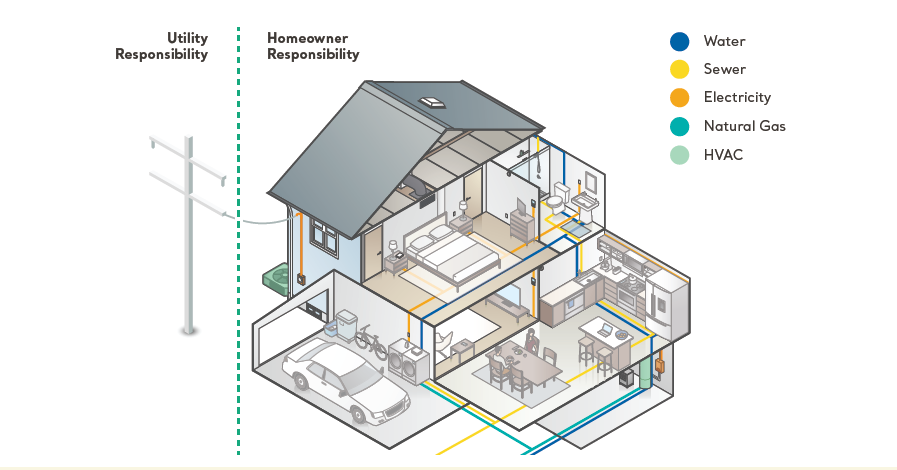

Depending on where that pipe or line lies, your utility might be off the hook for covering repairs. (Keep in mind that, unlike other equipment in your home, utility lines aren't easy to see — and aren't replaced until there's a failure.) In the illustration to below, you’ll see what’s typically identified as the utility’s responsibility when something goes wrong — and what’s the homeowner’s responsibility.

Why home warranty protection matters

First, let's look at what your home insurance does cover. These plans typically provide compensation for damage, loss or injury of property or personal belongings due to fire, theft, accidents or other listed perils. It's incredibly important to secure a homeowners insurance policy, as it protects against unpredictable accidents that can be quite costly. (While financial security is on the rise, nearly 25% of Americans don't have any emergency savings.)

What homeowners insurance doesn't protect against are the more likely costs that come up as your home ages, including lines, systems, and appliances that fail due to wear and tear.

How a home warranty plan fills gaps in protection

You’re likely aware that line and system failures are likely to come up at some point, but it’s hard to predict when these failures will happen. Consider this scenario: You walk outside into your yard to find water bubbling up in your grass. What can you do? Who do you call?

For our home warranty customers, the first step is to call IGS Energy and let us handle dispatching a reputable contractor to your home for the assessment and repair. If a protected line or system fails, our home warranty plans can provide thousands of dollars of protection — many with $0 out-of-pocket spend for the customer. Another benefit: Even if your problem isn’t covered, our team can help with next steps, including finding the right pro to fix the issue.

To learn more about how a home warranty plan can fill the gaps in your homeowners insurance coverage — and keep your home running smoothly — check out our home warranty FAQs.

For more details, contact IGS Energy's home warranty experts at 888.974.0113.